IRS

Address of Levying office

City Sate Zip

We are in receipt of your Form 668-W regarding one (worker's name). (Company name) is committed as a matter of policy, and civic duty, to upholding the law, and it is our sincere desire to comply with all lawful obligations to which we are subject. You suggest such an obligation in your form, but we are troubled by what appear to us to be several areas in which your presentations, the statutory authority under which they are made, and the facts regarding (worker's name) do not seem to mesh well.

We have read the statutes under the authority of which you claim to be acting (represented at 26 USC 6331 and following), including the portions which you have omitted from the back of your form. The statutes specifically and exclusively identify federal workers (meaning those working directly for the federal government and those working for federally-connected entities) as entities whose unpaid compensation can be attached by way of a 'Notice of Levy' (and then, of course, only when liability has been properly established): "6331(a)... Levy may be made upon the accrued salary or wages of any officer, employee, or elected official, of the United States, the District of Columbia, or any agency or instrumentality of the United States or the District of Columbia, by serving a notice of levy..."

In light of the basic legal principle of "Inclusio unius est exclusio alterius,"(The inclusion of one is the exclusion of another. The certain designation of one person is an absolute exclusion of all others. ... This doctrine decrees that where law expressly describes [a] particular situation to which it shall apply, an irrefutable inference must be drawn that what is omitted or excluded was intended to be omitted or excluded, Black's Law Dictionary, 6th edition)-- and the fact that (worker's name) is not a federal worker (relevant to any payments owed by this company, at least)-- we are unable to perceive how the statutes apply in this case. This understanding is reinforced by the (exclusive) specification in 26 CFR 301.6331-1 (the regulatory structure by which 26 USC 6331(a) is implemented) of three separate categories of workers to whom the relevant levy provisions apply. The three categories consist of those identified in the statute as noted above, as well as:

(ii) State and municipal employees. Salaries, wages, or other compensation of any officer, employee, or elected or appointed official of a State or Territory, or of any agency, instrumentality, or political subdivision thereof, are also subject to levy to enforce collection of any Federal tax.

(iii) Seamen. Notwithstanding the provisions of section 12 of the Seamen's Act of 1915 (46 U.S.C. 601), wages of seamen, apprentice seamen, or fishermen employed on fishing vessels are subject to levy.

We presume that 'State and municipal employees' and 'Seamen' refer to those of the federal States, municipalities and Territories (as defined in the relevant revenue statutes), and federally commissioned mariners, respectively; however, such details are moot. The inclusion of these specifications unambiguously contradicts any suggestion that the authority of the levy power in regard to compensation can or should be presumed as extending beyond those entities specified, for were that actually the case, subparagraphs (ii) and (iii) cited above would be entirely superfluous and redundant. If the compensation of literally any person actually can be, or lawfully is, reached by these levy provisions, then no further specification would be needed. That these specifications are provided proves that this is not so. Within the context of the statute, 'any person' clearly DOES NOT mean "each and every American", it means "any person that is among the groups specified".

Furthermore, even if we were inclined to entertain uncertainty in that regard, we are also mindful of the United States Supreme Court's instructions in American Banana Co. v. United Fruit Co., 213 U.S. 347 (1909) that,

"Words having universal scope, such as 'every contract in restraint of trade,' 'every person who shall monopolize,' etc., will be taken, as a matter of course, to mean only everyone subject to such legislation, not all that the legislator subsequently may be able to catch." ,

and in Gould v. Gould, 245 U.S. 151 (1917) that,

"In the interpretation of statutes levying taxes it is the established rule not to extend their provisions, by implication, beyond the clear import of the language used, or to enlarge their operations so as to embrace matters not specifically pointed out. In case of doubt they are construed most strongly against the government, and in favor of the citizen."

As our obligation to (worker's name) is entirely unambiguous, we find it impossible to honor your directive without clarification.

Finally, we are aware of the fact that the indemnification language provided in 26 USC 6332(e) which you have presented to our attention is highly provisional. That language,

"(e) Effect of honoring levy

Any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made who, upon demand by the Secretary, surrenders such property or rights to property (or discharges such obligation) to the Secretary (or who pays a liability under subsection (d)(1)) shall be discharged from any obligation or liability to the delinquent taxpayer and any other person with respect to such property or rights to property arising from such surrender or payment.",

clearly offers indemnification only as to the surrender of property "subject to levy upon which a levy has been made", which is to say, property upon which a levy CAN be made, and upon which a levy HAS been made. Thus, the indemnification only protects us if the property you are seeking IS "property [lawfully] subject to levy,"AND if a levy has been lawfully made upon that property. Not only does it appear self-evident that neither of these requirements have been satisfied in regard to your demand, but you have furnished no evidence of any kind to the contrary-- not even so little as a sworn declaration by someone in your organization willing to take personal responsibility for your representations as to these matters.

Such a sworn declaration, invoking the penalties of perjury against the signer, is the very least starting point at which we could begin contemplating that we might be under an actual legal obligation which overrides our known duty to (worker's name). (Indeed, it seems to us that any presentment as to either of these issues which is anything less than the formal conclusion of an independent court, in consequence of a proper adversarial proceeding, self-evidently cannot be sufficient, but further consideration along that line is premature at this point.)

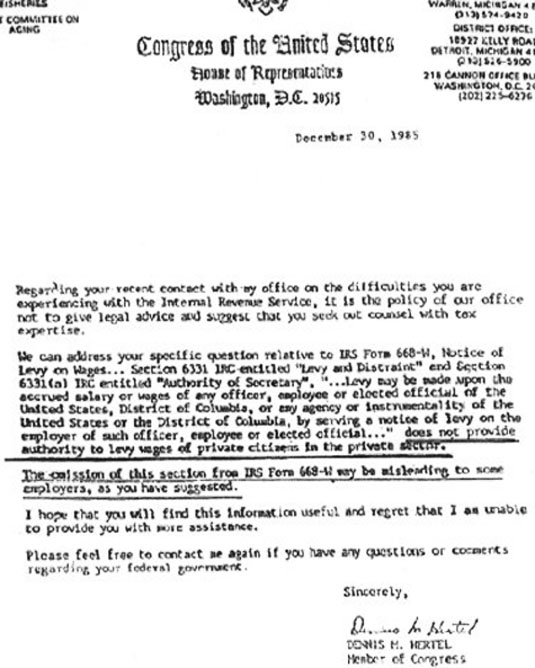

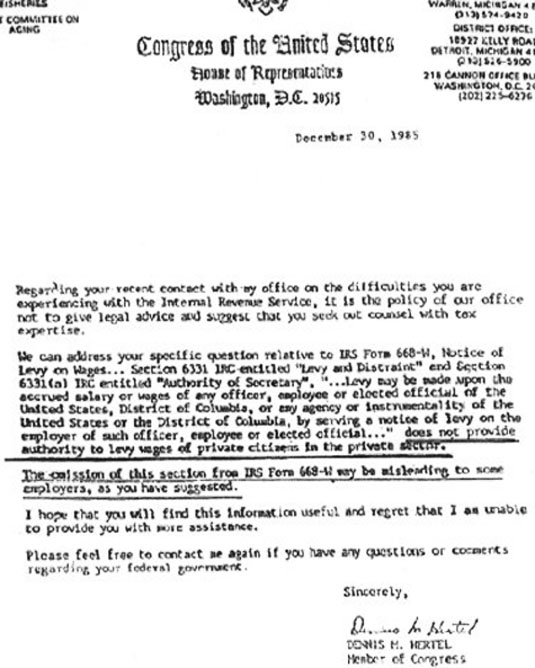

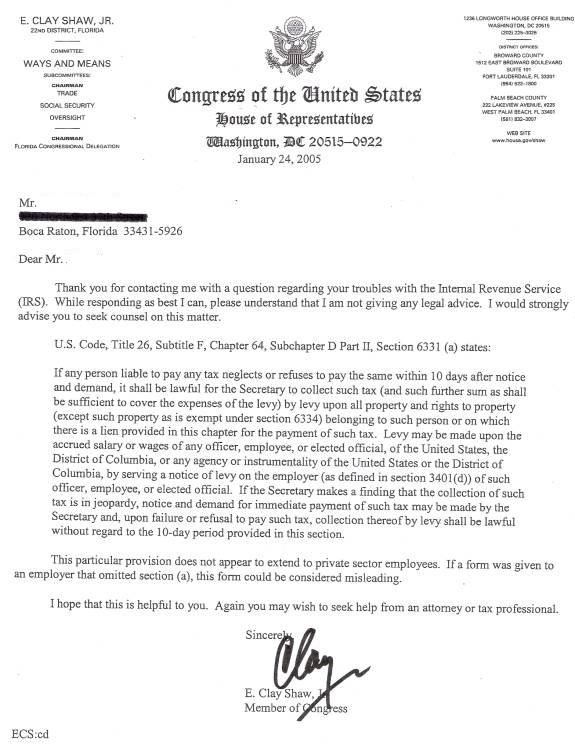

Please also note the enclosed letters from Congressmen regarding this issue which we base our request on.

Therefore-- in order to ensure that no one is the victim of a misunderstanding; and to protect (company name) from the possibility of legal action against us for any of several possible criminal and civil offenses which would be attendant upon our diversion of money which is legally the property of another if done other than as strictly and unambiguously required by law-- we respectfully and in good faith ask that the following statement be executed by someone of sufficient authority in your agency and returned to us, whereupon we will give prompt consideration to your request:

(Company name), a private-sector, non-federally-connected (union-state of origin) enterprise, is required by law to pay over to the Internal Revenue Service-- upon its demand by way of 'Notice of Levy' and in the absence of any court order supporting that demand-- a portion of the money (company name) owes to (worker's name) for work performed by (worker's name) on (company name's) behalf and under its direction per the terms of the agreement that exists between these two parties. This is true even though the work for which this money is owed in no way involves any activities by, or any status of, (worker's name) as an officer, employee, or elected official, of the United States, the District of Columbia, a State, Territory, or Possession, or any agency or instrumentality of one or more of the foregoing, or as an officer of a corporation [if necessary, add "a majority of the stock of which is owned by or on behalf of the United States, or the power to appoint or select a majority of the board of directors of which is exercisable by or on behalf of the United States"]. Furthermore, I am empowered to declare, and do hereby declare, that (company name) is fully indemnified against any and all possible civil or criminal liability-- to any party and under any jurisdiction-- for doing so, and do hereby promise to personally reimburse (company name) for any amount for which it should be held liable in connection with its compliance with this demand:

I declare under penalty of perjury that all of the foregoing is true to the best of my knowledge and belief.

_________________________________ _____/____/____

(Signature of testifying officer) (Date executed)

_______________________________________________________

(printed name and title of testifying officer)

_________________________________ _____/____/____

(Signature of witness) (Date executed)

_________________________________ _____/____/____

(Signature of witness) (Date executed)

Thank you for your help in this matter.

Sincerely,

Employer/Company Name, etc.